Wealth Management

Financial planning serves as a blueprint for your financial journey, enabling you to establish and pursue specific objectives such as retirement savings or homeownership. In contrast, wealth management…

At Valor Legacy Wealth®, our advisors specialize in Retirement planning, Divorce consultation, Medicare, Life Insurance strategies, and building a lasting relationship with our clients. In coordination with Brookstone Capital Management, our Valor clients have access to advanced investing opportunities and strategies.

Financial planning serves as a blueprint for your financial journey, enabling you to establish and pursue specific objectives such as retirement savings or homeownership. In contrast, wealth management…

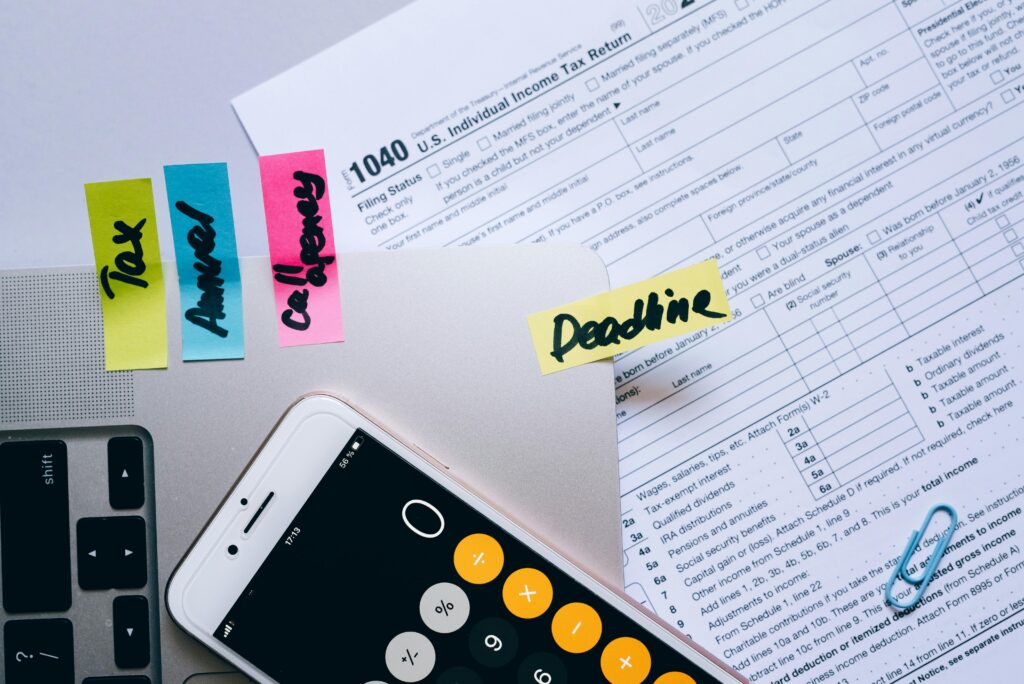

Tax planning is essential for minimizing your tax liabilities, allowing you to retain a larger portion of your income and optimize your financial strategies. By leveraging…

Retirement accounts such as 401(k)s and IRAs serve as essential financial pillars for securing the lifestyle you desire after your working years. These plans provide significant tax benefits that…

Long-term care planning is essential for ensuring that you are both financially and practically equipped for future health needs. As you age, you may require…

Life insurance strategies and Medicare insurance play crucial roles in safeguarding your financial future. By selecting the appropriate…

We are here not only to assist but also to provide long-term support to our clients as they navigate each chapter of their lives. A relationship that goes beyond advisement!

ServicesOur first meeting is all about introductions and getting to know you. James takes the time to learn about your financial situation, goals, and concerns. This conversation lays the foundation for building a personalized financial plan that reflects your needs and aspirations.

In the second step, we analyze your current financial situation and evaluate any existing plans. Whether you’re starting from scratch or refining a strategy, James works with you to explore options tailored to your goals. Together, you’ll discuss potential solutions and set the stage for creating a roadmap designed to meet your specific needs.

During the second meeting, James presents a detailed plan with clear steps to help you achieve your financial objectives. He explains where the plan leads, what actions are required, and answers all your questions. Once you approve, James will implement the plan. A follow-up meeting ensures that every detail is reviewed and that any final adjustments are made before moving forward.

Financial plans aren’t static. As a fiduciary, James provides continuous support to evaluate, manage, and adjust your plan as needed. Life changes, and your financial strategy should adapt to ensure you stay on track toward your goals.

AIF®, RICP®, NSSA®

James Regan is driven by a mission to empower others. After noticing gaps in financial education, he immersed himself in market mastery, studying the Wall Street Journal daily for years.

A decorated Air National Guardsman & veteran, (three deployments), he earned the Air Force Achievement Medal along with many additional achievements’ awards for his service. James also served as chairman of the board for 2 years of the AZ non-profit Military Assistance Mission, supporting military families.

As founder of Valor Legacy Wealth®, Jim serves as a fiduciary, crafting unbiased financial roadmaps to help clients achieve their goals. His credentials, Accredited Investment Fiduciary (AIF®), Retirement Income Certified Professional (RICP®), National Social Security Advisor (NSSA®) and training from Ed Slott’s elite IRA advisory group reflect his expertise in retirement and tax-efficient planning.

Jim holds a finance & marketing degree from Illinois State University and thrives on family life with his wife, Merian, and their three children, Eliana, Pierce, and Colette.

Testimonials

We've assisted clients from all walks of life. Regardless of your current situation, we adapt and strategize around your life. You're not working with just an advisor; you're working with a dedicated partner.

Retirement Wealth Academy

635 N Power Rd, Mesa, AZ 85205

10:30 am - 12:00 pm

Financial | Retirement planning | Medicare | Life insurance

At Valor Legacy Wealth®, starting the conversation to help understand the different paths one could take is a good place to start. Never the pressure of committing, instead, forming a trusted relationship for the future.